Table of contents

Scheduling automation gives you an edge over your competitors in wealth and asset management, insurance, banking, and lending.

How so? Scheduling automation helps you:

Win new clients faster: Prospective clients connect with you quickly and easily, thanks to a modern booking experience.

Deepen client relationships: Client-facing teams are more efficient because they have fewer admin tasks each day, which lets them spend more time with clients.

Reduce no-shows: Clients are more engaged and more likely to show up to appointments because they automatically get appointment reminders and other routine communications.

In this article, we’ll cover three ways financial services organizations are using scheduling automation throughout the client journey, for everything from intro calls with new clients to account reviews with lifelong ones.

1. Modernize the booking experience for prospective clients

An exceptional client experience gives you a competitive advantage. In a study of 13,000 customers, 88% believe their experience with a business is as important as the quality of its products and services.

With the next generation of digitally savvy investors, a modern client experience is a necessity. Despite this, many financial services institutions are still manually scheduling appointments via back-and-forth emails or games of phone tag.

Not only is this frustrating for your clients, but it’s time consuming for your team and can result in prospective clients signing with a competitor who’s easier to connect with.

Digitize scheduling for new client acquisition

Churchill Mortgage became believers after they adopted Calendly and saw $415,000 in labor cost savings. The lender’s process for connecting prospective clients with a loan specialist licensed in their state was slow and frustrating. Prospective clients were waiting on hold for too long, and Churchill had to manually schedule callbacks if no one was available.

When demand for Churchill’s services exponentially increased and their team got overwhelmed, they needed a solution that would multiply the team’s reach while providing excellent customer care. The team created a digital self-serve system and incorporated Calendly’s scheduling automation platform into its workflow.

Here’s how Churchill implemented Calendly to modernize their scheduling process:

After choosing their home state in an online contact form, prospective clients are directed to a Team Page so they can immediately schedule a meeting with a home loan specialist licensed in their state.

Behind the scenes, Round Robin automatically directs prospects to the first-available team member, eliminating long wait times and helping the team manage client distribution.

Once a meeting is booked, automations help home loan specialists stay in touch with clients and make sure they show up to their appointments.

By using Calendly’s scheduling automations, Churchill eliminates an enormous amount of manual work and ensures every client has a first-class experience, while remaining secure and compliant.

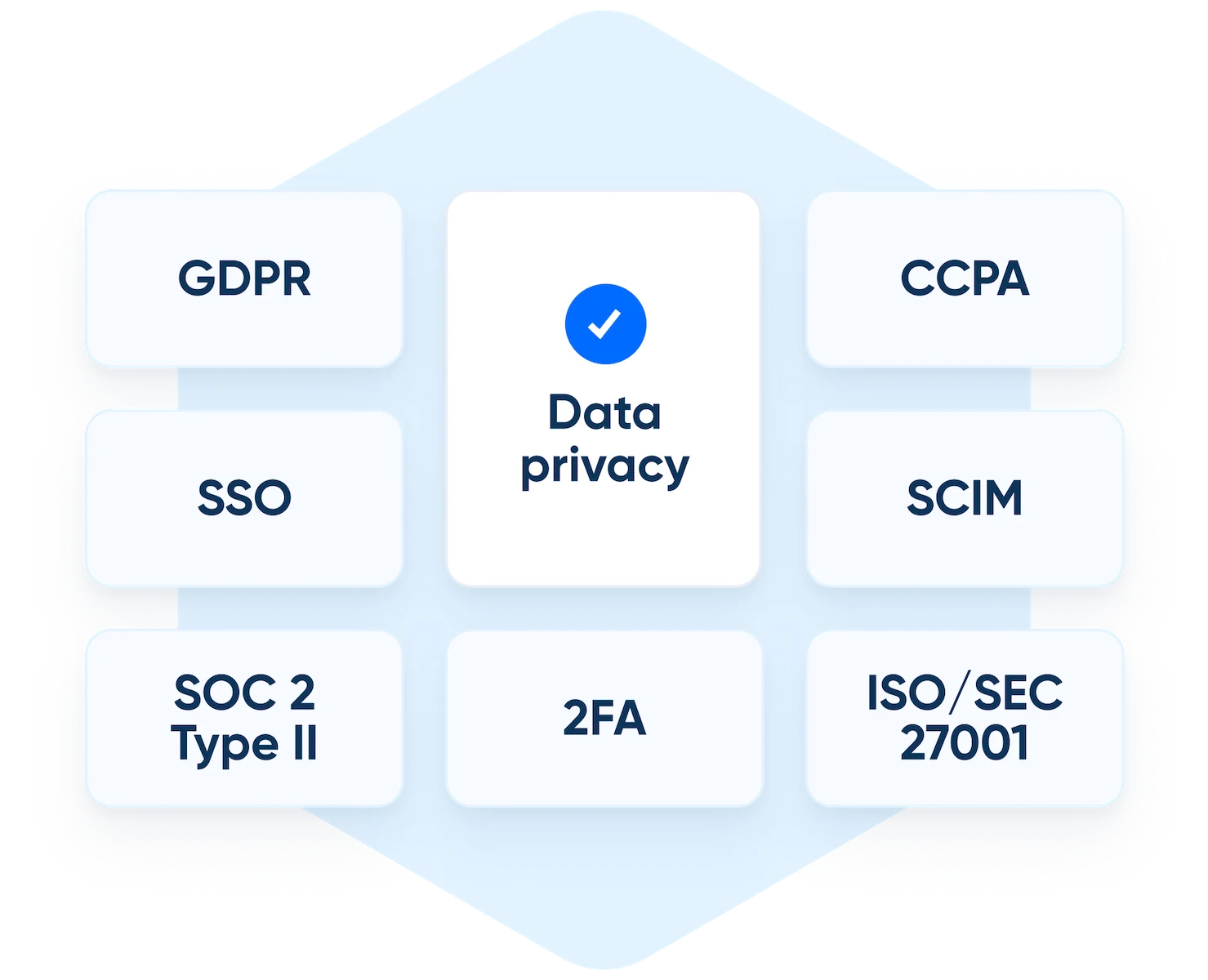

Protect your business, clients, and reputation

In highly regulated financial institutions, minimizing risk and remaining compliant are top priorities. In addition to a dedicated team of security experts, Calendly offers enterprise-grade security and compliance, including email communication archiving and domain control, so you can rest easy knowing your business, clients, and reputation are protected.

Seamlessly route referrals

For Churchill, advertising with a strategic referral partner is an important source of inbound leads.

Churchill wanted prospects coming from the referral partner’s site to receive the same personalized schedules and communications as everyone else. By embedding scheduling into their website, and qualifying prospects with Calendly Routing Forms, Churchill offers a streamlined scheduling experience regardless of where prospects come from.

“People can fill out a contact form on [our partner’s] website to connect with us. With Calendly’s API, that information comes over to our system and the customer gets immediately routed into the right home loan specialist’s pipeline. It’s been a game-changer.”

Nancy McMahan

Director of Client Engagement at Churchill Mortgage

Make outbound easier

In today’s economic climate, more and more financial services organizations rely on outbound business development — or “cold” calling and emailing — to engage prospective clients. While outbound business development takes some manual effort, Calendly’s scheduling automation platform makes it easier. You can include your calendar availability directly in outbound emails without leaving your workflow.

So whether you’re sending personalized emails straight from your inbox, engaging prospective clients on LinkedIn, or sending emails through a marketing campaign, you can easily add your scheduling link or include suggested meeting times with the click of a button. That way, a prospective client can instantly book a time to connect with you, instead of having to call or email you back.

Webinar: How Educators Drive Student Success with Calendly

2. Increase efficiency to spend more time with your clients

A recent study found that financial advisors only spend 20% of their time meeting with clients, and almost double that on behind-the-scenes tasks. Just think what it would be like to reduce that admin load. How many more new client meetings could you take a year? How much more time could you devote to your existing clients?

By eliminating time wasters (like back-and-forth scheduling via email), you have more time to focus on what matters most: your clients. In turn, doing more client engagement lets you support more high-value clients and drive more revenue.

Save time and modernize client outreach

Before Calendly, CI Assante Wealth Management’s financial advisors and assistants were struggling with all of the back-and-forth emails it took to schedule meetings with clients. They spent hours every day scheduling meetings via email — valuable time they could have spent meeting with their clients.

Now, Asante’s advisors use scheduling automation to connect with more clients while reducing admin work. Advisors can offer multiple types of meetings with one link, allowing clients to choose whether to meet virtually, by phone, or in-person.

“It was a big win for the advisors to be able to give clients those options,” said Asiya Khan, CI Assante’s Branch and Business Practices Consultant. “And with our team schedules, they could even choose to meet with a different advisor. In the finance industry, we always strive to put our clients first.”

Another way CI Assante is giving advisors more time back to focus on clients is by automating routine communications, such as meeting reminders and follow-ups.

“Scheduling meetings was a big pain point with advisors, but we solved that with Calendly. Now, they’re able to focus their time and energy towards things that matter more.”

Asiya Khan

Manager, Branch and Business Practice at CI Assante Wealth Management

Simplify group scheduling

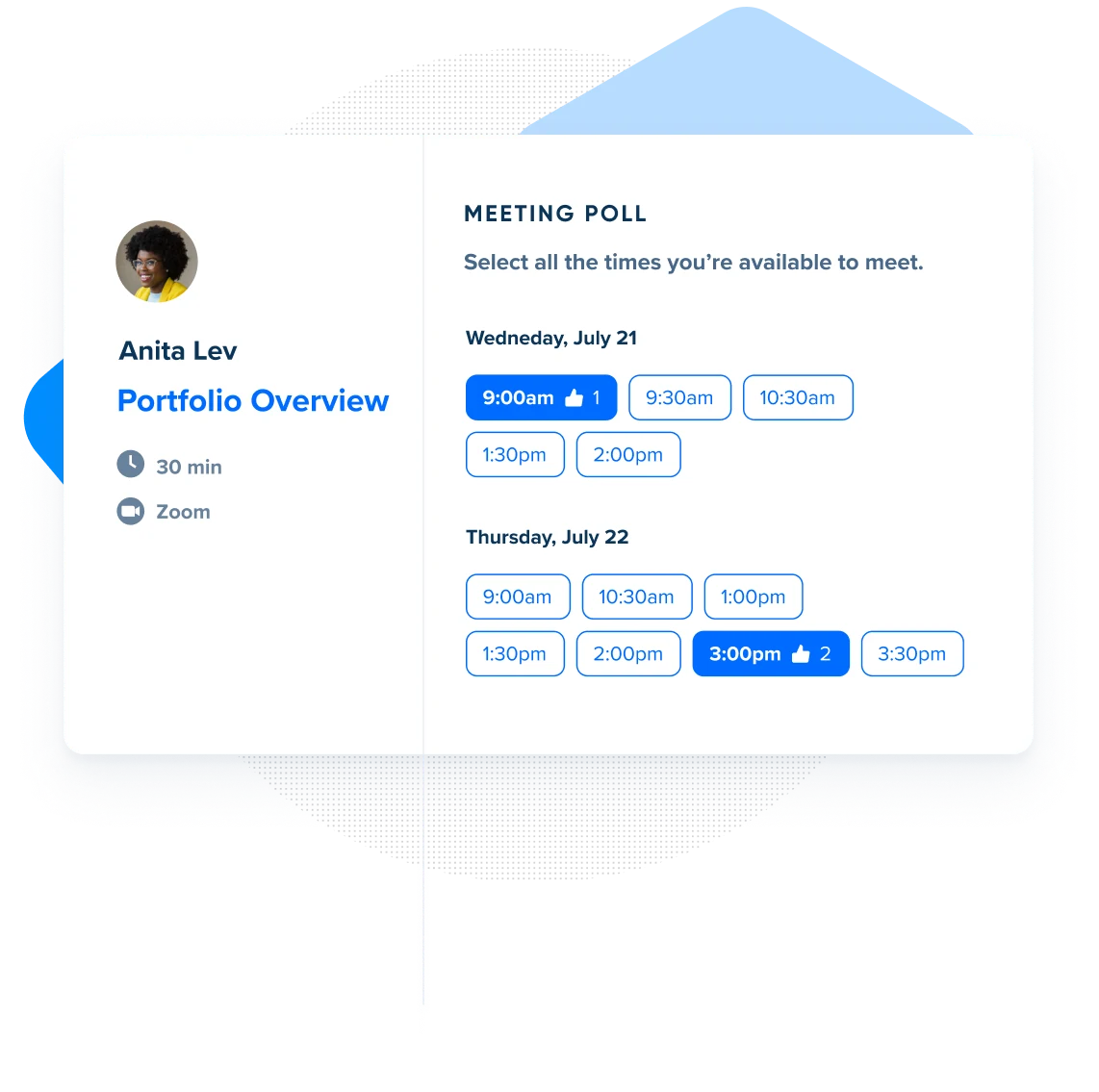

While many meetings in financial services are one-on-one, there are occasions when you need to convene multiple clients. Have you ever needed to include external parties like a client’s accountant, or have other internal experts join an appointment, like a fund manager or subject matter expert? Calendly's multi-person scheduling options make it easy for several people to meet with you at once. For example, CI Assante’s financial advisors started using Meeting Polls to easily schedule three-way meetings with clients and their accountants at tax time.

Since implementing Calendly, CI Assante’s financial advisors have saved over 13,000 hours and advisors have increased client reach by 143%.

Hear from Asiya as she shares how Calendly helped CI Assante’s financial advisors improve efficiency while modernizing the client experience:

3. Boost client engagement to create lifelong relationships

Ideally, the client journey is lifelong for financial services companies.

The key to lifelong clients? Building a bond of trust. According to a recent study, one of the top reasons that clients fire their financial advisor is due to the quality of their relationship. You can’t keep a client happy for life unless you understand your client and their specific financial needs and goals.

And how does scheduling automation help you build that trust? It allows you to connect with clients whenever and wherever they need your help, from easing anxiety about recent market volatility to updating an insurance policy when a client has their first child.

You’re more available: Clients can easily self-schedule an appointment when they have an issue. You get to respond to them faster, so at their time of need you can show empathy, find solutions, and continue growing your relationship.

Clients show up: You can only help clients if they show up to their appointments. No-shows are drastically reduced when you automate reminders and reconfirmations. Those can be sent via email or text within minutes, hours, and/or days before a scheduled appointment.

You send the right message at the right time: Automated workflows help keep the lines of communication open between appointments. Send personalized thank-yous after each appointment, offer helpful resources based on the type of meeting they booked, or request a follow-up appointment after a certain amount of time has passed since your last appointment.

Improve efficiency and grow your business with scheduling automation

Every day, your clients self-schedule appointments with their dentist, their hair stylist, their accountant … and they expect to be able to do the same with you.

Once you modernize your booking experience for clients, you’ll enjoy time savings, higher client retention, and more new business.

See why businesses and Fortune 100 companies across the financial services industry trust Calendly to streamline scheduling and create a modern client experience. Sign up for free today.

Learn more about Calendly

Related Articles

Don't leave your prospects, customers, and candidates waiting

Calendly eliminates the scheduling back and forth and helps you hit goals faster. Get started in seconds.

Calendly eliminates the scheduling back and forth and helps you hit goals faster. Get started in seconds.